Hey there 👋

Supply of PC components is always under some form of threat especially when a new tech hype cycle starts.

Back in COVID-19 days, GPUs were the hot thing because Crypto miners and Web3 guys just couldn’t get enough of them.

A similar scenario has shown its face but this time in the form of exponentially rising NAND and RAM prices.

What’s NAND flash you may ask? To put it simply, it’s the main thing that powers your SSDs.

NAND flash stores data really fast and permanently and is the dominant storage we use in everyday electronics.

NAND flash is the foundational storage we have in our PCs, smartphones, gaming consoles, etc.

Now, NAND flash is permanent storage but RAM is where temporary data is stored when a computer is running. It is a very fast form of storage that is refreshed many times a second to store new data.

Basically, almost all modern computers, be they giant PCs or small smartphones, use some form of NAND flash and RAM to function properly.

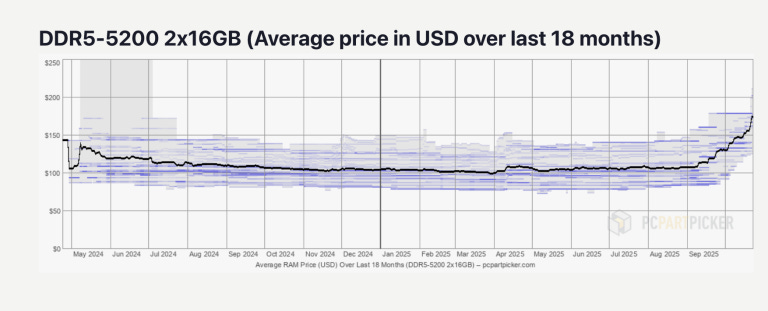

Recently, consumers like you and me have seen RAM and SSD prices hit the roof as they’ve become 3-4 times (that’s 300-400%) the prices from just a few months ago.

Shops are revising RAM and SSD prices every week and a lot of uncertainty clouds us as we start 2026.

This sudden increase in prices of NAND is due to a couple of reasons and we’ll go over the most important ones in this piece and try to see how the short-term future of consumer hardware looks like.

Some Context And How We Got Here

The Post-Pandemic Situation

To understand why RAM and SSD prices are climbing today, you have to go back to 2022–2023. During the pandemic, PC makers, phone brands, and data centers overestimated how long demand would stay high.

Because many of us were going online and buying new computers, memory manufacturers ramped up production expecting permanent growth. That demand didn’t arrive.

By 2023, the industry had excess RAM and NAND flash. Prices collapsed to historic lows.

SSDs became absurdly cheap, and RAM kits dropped hard. Analysts said that NAND and DRAM prices were falling because warehouses were full and buyers had stopped ordering new stuff.

This oversupply hurt manufacturers badly. Samsung, Micron, and SK Hynix all reported steep drops in memory revenue and profit.

For consumers, this was great. For companies, it was bleeding money.

Oversupply Reaction

In this excess supply, The memory industry did the only thing it could do. It cut supply.

Starting late 2023 and continuing through 2024, the three biggest memory makers - Samsung, SK Hynix, and Micron - began aggressive production cuts.

Some estimates put these cuts anywhere from 20 percent to over 50 percent depending on the product line. Kioxia and Western Digital followed similar strategies on the NAND side.

These were not small adjustments. Wafer starts were reduced, fabs were idled, and expansion plans were delayed.

Samsung publicly acknowledged that it was reducing memory output to stabilize prices, breaking from its usual strategy of maintaining volume at all costs.

The goal was simple: stop the price free-fall and return memory to profitability.

AI Enters The Chat

The cuts worked. But at the same time, a new source of demand arrived: AI infrastructure.

By late 2024 and into 2025, demand for RAM and SSDs returned sharply - but production had not.

Memory supply was now tight just as buyers started ordering again. Micron warned investors that DRAM and NAND shortages could extend into 2026 because demand was recovering faster than capacity.

This mismatch between lower supply and rising demand is the foundation of today’s price increases.

Why Are RAM Prices Rising Today?

I’ll try to answer this question in the form of three pillars. I feel that talking in threes makes it simple to understand, which is the whole point of this article.

1st Pillar - AI Eats Memory & SSDs, Not Just GPUs

AI is usually discussed in terms of GPUs (that’s true), but GPUs are useless without memory. Training and running modern AI models requires massive amounts of RAM and extremely fast storage (SSDs).

GPUs themselves use RAM too but AI servers use far more RAM than traditional servers.

Estimates say that AI workloads require several times more RAM than conventional cloud workloads. That demand comes directly out of the same supply pool used for consumer RAM.

Data centers training large models store huge datasets on enterprise SSDs, not hard drives.

SSDs are faster, and AI workloads need speed. This is why AI data centers use high-capacity SSDs instead of old and slow hard-drives.

When hyperscalers buy memory in bulk, supply in consumer markets gets lower and thus stuff gets expensive for us.

2nd Pillar - Memory Makers Follow the Money

Most of the price increases in RAM and NAND simply come down to:

Money!

Money!!

Money!!!

Just as George Orwell said in his infamous 1984:

All RAMs are equal, but some are more equal than others.

Enterprise customers pay more and sign long-term contracts which means more business. Faced with this simple reality, memory manufacturers are prioritizing data centers over consumer RAM and SSDs. This is basic business.

They can make more money, they make more money.

Micron, SK Hynix, and Samsung have all stated that enterprise and AI-related demand now drives their memory roadmaps. Consumer RAM and low-end SSDs are simply not the priority they once were.

Some companies like Micron have completely shut down their consumer RAM divisions in favor of AI datacenter demand that generates them way more business than us peasants :\

This means fewer chips end up in our gaming PCs, even if overall production looks stable on paper.

3rd Pillar - Making Memory Is Getting More Expensive

Even without AI, memory is no longer cheap to make. Newer NAND and DRAM processes are also getting more expensive, and take a lot longer to ramp. Fewer usable chips per wafer means higher cost per gigabyte.

TrendForce notes that advanced NAND production has higher costs and slower yield improvement, which limits how quickly supply can respond to demand spikes.

This quietly puts a floor under prices. The days of endless cheap SSDs were an anomaly, not the norm, at-least no more :\

The Ripple Effect: Who is Getting Hit?

The Consumer Segment

Right now, the memory market is behaving like an executive club where the biggest, richest customers go first.

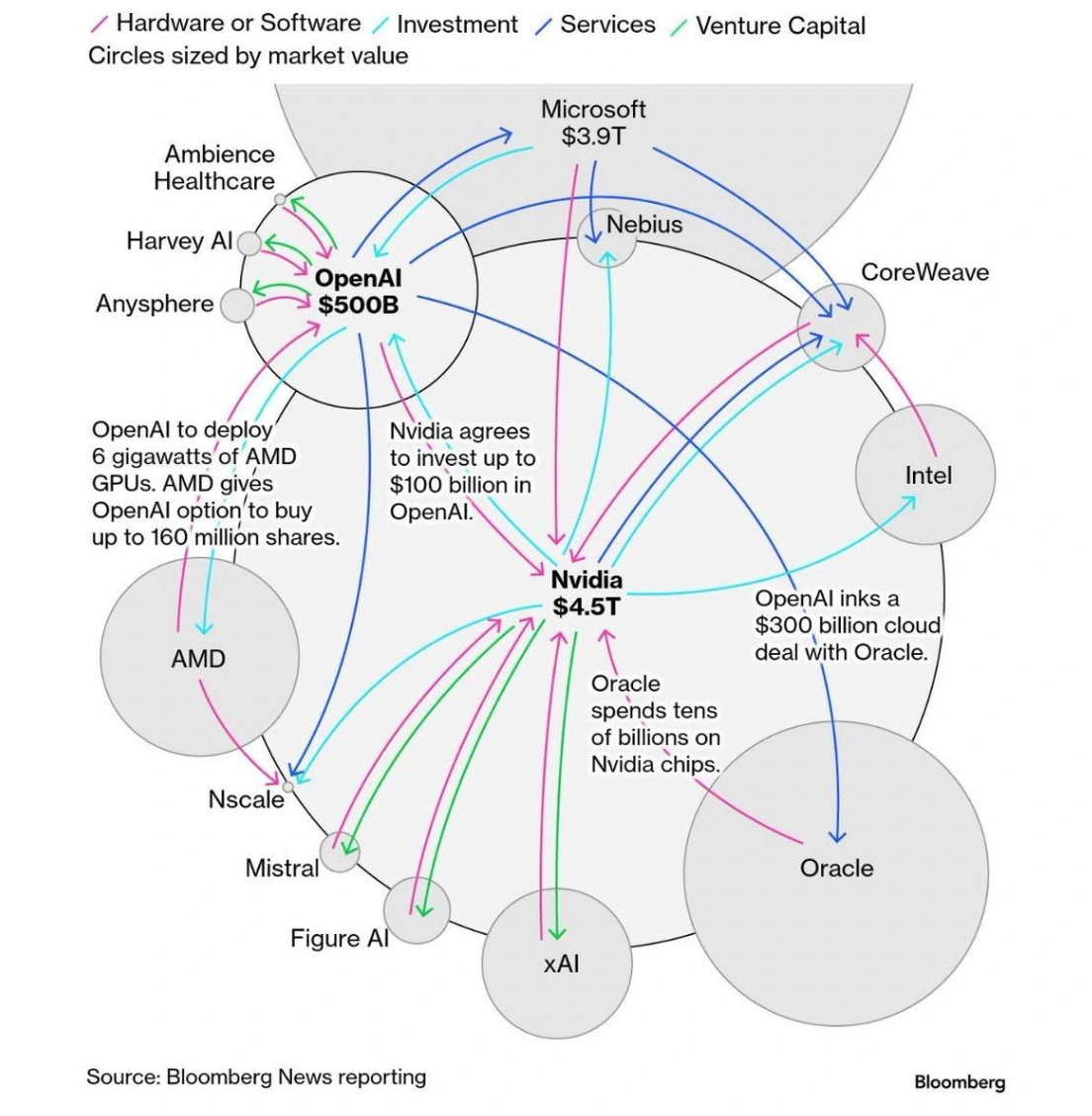

Hyperscalers like Amazon, Google, Microsoft, Meta, and OpenAI lock in long-term, high-volume contracts for both RAM (DRAM) and SSD storage (NAND flash) years before they actually need it.

Because these companies buy at such scale and often pay a premium to secure capacity, memory makers increasingly allocate production to them first, leaving smaller buyers with what’s left.

Because of these expensive contracts, prices for conventional DRAM have risen to about 3-4x by the end of 2025. Similarly, consumer SSD prices have also jumped.

When enterprise customers hoard available memory supply, consumer markets overflow.

That means PC builders, laptop makers, small OEMs, and smartphone brands often have to wait longer or pay more for the same DRAM and NAND that used to be abundant.

In the end, us consumers who need RAM and SSDs inside our PCs, consoles, laptops, smartphones are being hit the most.

We’re not OpenAI who could spend billions on securing premium RAM contracts. We hunt for discounts and best possible deals for our purchases.

This simply isn’t good enough for manufacturers from a business perspective and that’s why they’re not prioritizing consumers at the moment.

Upcoming Smartphones

This year we’re going to see new phones released with significant increases in their prices because phone manufacturers are also taking a hit when buying new RAM.

For us consumers, this translates to:

Base models with less memory - Phones that used to ship with 12 GB RAM may now ship with 8 GB at the same price point.

Smaller storage tiers becoming the default.

Price stagnation or even increases compared to prior generations, even when other components stay similar.

An industry report warns that rising RAM costs may increase production costs per device by 8–15 percent and dampen demand, especially for entry-level phones where margins are already thin.

So, if you have a good smartphone working for you. It’s better to stick with it for as long as this AI bubble stays with us.

PC And Gaming

If you’ve tried to build or upgrade a PC recently, you’ve probably felt the memory pinch.

A couple of months ago I built my PC with a humble 16 GB DDR4 kit. Turns out now the RAM costs more than half of what I paid for my complete PC.

Mainstream tech outlets have shared that enthusiasts are seeing RAM costs two to four times higher than a few months earlier.

This doesn’t just affect hobbyists - OEMs like Dell and Lenovo are feeling it too. SSDs are also in a similar boat because they use NAND flash.

For gamers and PC builders, the result is:

Budget SSDs become more expensive, especially in the 1–2 TB range.

RAM kits at popular sizes (e.g., 16 GB DDR5) are often priced higher or temporarily out of stock.

Overall PC builds get expensive, making mid-range gaming builds noticeably more expensive than a year ago.

Even consoles and handhelds may not escape this pricing mess. Especially upcoming hardware like the Steam Machine, PlayStation 6 or the rumored XBOX.

Geopolitics And Alternative Players

Memory supply is not entirely a technical story - it’s somewhat geopolitical too.

One of the big wildcard players has been China’s YMTC (Yangtze Memory Technologies), which plans to increase its share of the global NAND flash market.

However, Western sanctions and restrictions on high-end semiconductor equipment limit how much YMTC can directly manufacture, particularly at advanced process nodes.

At the same time, governments in the US, Japan, and Korea are pouring subsidies into memory fabrication under programs like the CHIPS Act.

These incentives are meant to expand future capacity for DRAM and NAND production, but fabricating memory takes years, and these facilities won’t materially ease supply until 2026–2027 at the earliest.

There’s also a broader concentration effect similar to CPUs: a handful of companies (Samsung, SK Hynix, Micron) still dominate memory production, and only a few alternatives have the ability to scale quickly.

Even companies traditionally on the consumer hardware side, like ASUS, have shown interest in manufacturing partnerships to diversify the ecosystem.

But those efforts remain early and won’t change the global supply picture in the short term.

Impact: A Structural Shift in Computing

When RAM and SSD storage become expensive, devices that were once treated as disposable start looking like long-term investments.

In these cases, people hold onto phones and PCs longer, reparability and memory upgrades become valuable again, and manufacturers face pressure to design for longevity.

At the same time, expensive local storage drives users toward cloud services.

Instead of buying massive SSDs for a laptop, many now opt for subscription-based storage because it spreads costs and avoids steep upfront memory expenses.

On the gaming side of things, one positive could be that developers are now forced to spend more effort into optimizing their video games so they can run on a larger net of hardware that isn’t all bleeding edge.

I feel this applies a lot in the PC gaming space where developers haven’t shown that big of an interest in game optimization like they used to.

Now that the PC hardware has become expensive for many, developers would need to ensure game optimization if they want to sell big numbers.

Is there an end in sight?

The short answer is: We don’t know (specifically, I don’t).

Some industry people are already warning that we could be in a prolonged memory pricing cycle. While many say that this is an AI bubble waiting to be burst.

Analysts project DRAM and NAND price increases continuing into early 2026, with contracts rising quarter-on-quarter.

Because as supply stays tight and demand, especially from AI and data centers, remains strong, prices will rise.

New fabs are coming online in 2026–2027 thanks to government subsidies and long-term expansion plans.

But memory fabrication lead times are quite long (usually multiple years), so even these new facilities will not immediately return prices to the cheap era of 2020–2022.

Normalization depends on whether demand stabilizes or continues to grow faster than supply. And this thing is the hardest to predict. We just don’t know how far this AI bubble will continue to expand.

How I See All Of This?

One thing is clear that this pricing situation doesn’t look like it’s temporary for just a couple of months.

The memory market is undergoing a structural change as it fills the demand we never saw. And this demand is exponential both in terms of hype and the money being flowed in.

Today we’re seeing everyday consumer devices compete directly with hyperscale data centers (having billions of dollars) for the same RAM and SSD supply.

These large companies don’t have trouble raising billions and dumping those to RAM manufacturers for premium chip contracts.

And considering that only a handful of companies in the entire world can scale at modern RAM and NAND manufacturing, the situation looks bleak.

A ray of hope for me would be Chinese companies if they scale on par with the big manufacturers. But I’d keep my hopes limited because I think it will take some time too.

Because we call ourselves ‘Tech Optimists’ here at SK NEXUS, it’s hard for us to be all that negative out here.

It’s true that consumer hardware went through a rough ride last year and it seems like 2026 may be no different. But it’s also true that investor-frenzy at-least at this level would come down one day or the other.

Global financial markets can’t stay stupid for long. True valuations and profits would have to show face and I think we’d see the consumer market improve.

And for those who are looking to buy PC hardware right now, the key is to buy stuff only when you need it and try not to feed into the hype or those trying to sell that everything’s going bad.

Solid explanation for these painful upgrade prices.

Wow, the breakdown of NAND flash and RAM was so well explained. Do you think these prices will stabalize later in 2026? Such an insightful piece, really aprecciate it!